Variable manufacturing overhead costs are indirect costs that fluctuate with changes in production levels. Examples include costs related to electricity, water, and supplies used in the manufacturing process. Overall, absorption costing adheres to GAAP principles for inventory valuation and provides a full allocation of all manufacturing costs to inventory and cost of goods sold. But the inventory values how to post a transaction in sundry sales and net income figures can vary significantly between periods as inventory levels and production volumes fluctuate. Absorption costing is an accounting method used to determine the full cost of producing a product or service. It may be beneficial to use the variable costing method depending on a company’s business model and reporting requirements or at least calculate it in dashboard reporting.

Create a Free Account and Ask Any Financial Question

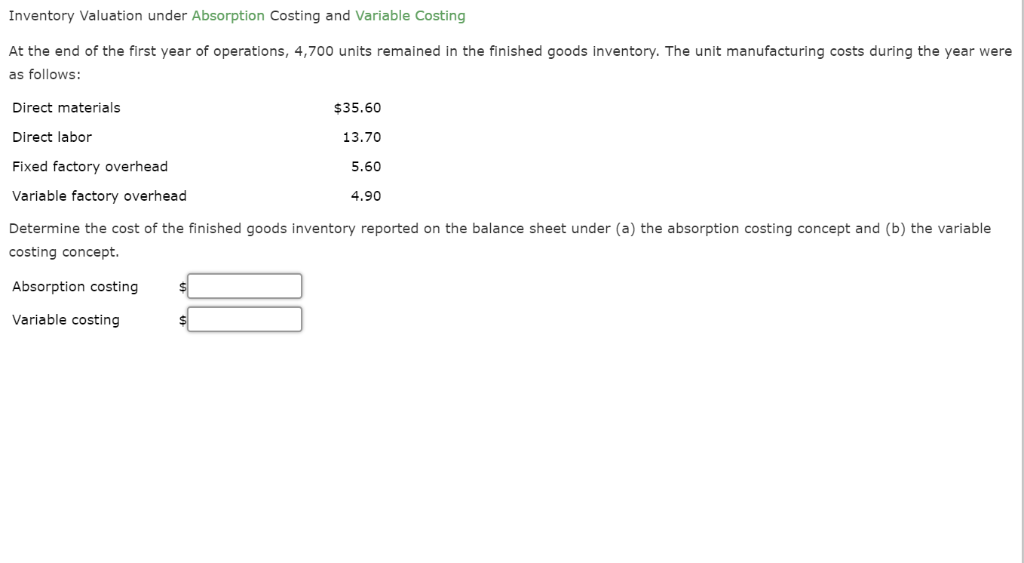

Those costs include direct costs, variable overhead costs, and fixed overhead costs. Absorption costing allocates all manufacturing costs, including fixed overhead costs, to the units produced. This differs from variable costing, which only allocates variable costs. Here are two examples showing how absorption costing is applied in practice. Absorption costing is a GAAP-compliant method of accounting for all manufacturing costs as product costs, including both variable costs and fixed overhead costs.

Ask a Financial Professional Any Question

- This could be a major problem when it comes to marketing and pricing your products.

- This cost includes direct production costs like materials and wages as well as a share of fixed costs allocated to each unit.

- The components of absorption costing include both direct costs and indirect costs.

- By allocating fixed costs to inventory, absorption costing provides a fuller assessment of profitability.

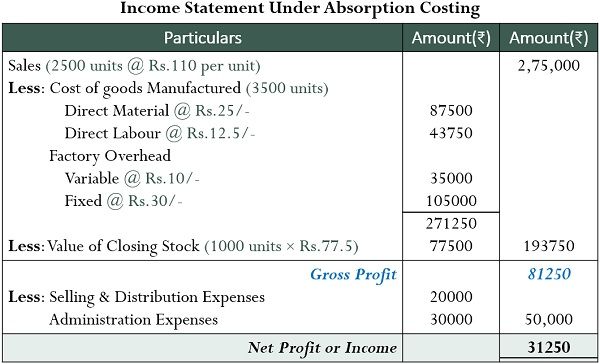

Next, we can use the product cost per unit to create the absorption income statement. We will use the UNITS SOLD on the income statement (and not units produced) to determine sales, cost of goods sold and any other variable period costs. The key difference in calculating the income statement under absorption costing versus variable costing is in how fixed manufacturing costs are handled. By allocating fixed overhead to units produced, absorption costing provides a more complete assessment of production costs. However, it can result in over- or under-costing inventory if production volumes fluctuate.

How confident are you in your long term financial plan?

Yes, you will calculate a fixed overhead cost per unit as well even though we know fixed costs do not change in total but they do change per unit. When we prepare the income statement, we will use the multi-step income statement format. The absorption costing formula provides a reliable approach to allocate both variable and fixed manufacturing costs to units produced, yielding precise per unit costs. This cost includes direct production costs like materials and wages as well as a share of fixed costs allocated to each unit. Understanding accurate unit costs is key for inventory valuation and pricing decisions.

Absorption Costing Formula: Accounting Explained

Moreover, there is no concept of overhead overabsorption or under-absorption. Product costs include all fixed production overheads as well as variable manufacturing expenses. Absorption costing (also known as traditional costing, full costing, or conventional costing) is a costing technique that accounts for all manufacturing costs (both fixed and variable) as production cost.

Absorbed overhead is manufacturing overhead that has been applied to products or other cost objects. Overhead is usually applied based on a predetermined overhead allocation rate. To complete periodic assignments of absorption costs to produced goods, a company must assign manufacturing costs and calculate their usage. Most companies use cost pools to represent accounts that are always used.

This eliminates the distinctions between fixed and variable costs, thereby reflecting the impact of overhead on manufacturing. If price per unit sold is $4.5, calculate net income under the absorption costing and reconcile it with variable costing net income which comes out to be $20,727. The accuracy of product costs under this technique is contingent on the proper allocation of overhead costs.

Many accountants claim that administrative, fixed manufacturing, and marketing and distribution overheads are period costs. They have little long-term value and therefore should avoid including in the product’s pricing. (c) There includes no differentiation made between fixed and variable production costs. As you can see, by allocating all manufacturing costs to inventory, absorption costing provides a more comprehensive assessment of profitability. With a higher COGS under absorption costing, gross margin is lower compared to variable costing. Absorption costing is normally used in the production industry here it helps the company to calculate the cost of products so that they could better calculate the price as well as control the costs of products.

The absorption cost per unit is $7 ($5 labor and materials + $2 fixed overhead costs). As 8,000 widgets were sold, the total cost of goods sold is $56,000 ($7 total cost per unit × 8,000 widgets sold). The ending inventory will include $14,000 worth of widgets ($7 total cost per unit × 2,000 widgets still in ending inventory). Absorption costing provides a more accurate, GAAP-compliant method of accounting for all production costs. By including fixed overhead costs in product costs, it presents a fuller, incremental view of profitability. The overall difference between absorption costing and variable costing concerns how each accounts for fixed manufacturing overhead costs.

Auditors and financial stakeholders will require it for external reporting. Small businesses may also be required to use absorption costing for their tax reporting depending on their type of business structure. Higgins Corporation budgets for a monthly manufacturing overhead cost of $100,000, which it plans to apply to its planned monthly production volume of 50,000 widgets at the rate of $2 per widget. In January, Higgins only produced 45,000 widgets, so it allocated just $90,000. The actual amount of manufacturing overhead that the company incurred in that month was $98,000. Assigning costs involves dividing the usage measure into the total costs in the cost pools to arrive at the allocation rate per unit of activity, and assigning overhead costs to produced goods based on this usage rate.